First Economic Impact (Stimulus) Payment

On March 27, a $2.2 trillion bill known as the CARES Act passed through Congress, and President Trump signed it into law.

The Act responded to the economic fallout of COVID-19 and allowed Americans to stay home to help combat the pandemic in America.

The bill includes $300 billion dollars for stimulus payments to individual Americans, $260 billion for increased unemployment benefits, $500 billion in loans for corporations, $339.8 billion to state and local governments and the creation of the Paycheck Protection Program (PPE loans) that provides forgivable loans to small businesses.

This bill did not come easily since Senate Majority Leader Mitch McConnell and House leader Nancy Pelosi were at odds with what they wanted out of the bill.

The Kentucky Republican urged Congress to pass an aid bill that contains neither legal immunity nor state and local government support— this caused a roadblock for Democrats trying to pass the bill.

“What I recommend is we set aside liability and set aside state and local, and pass those things that we can agree on knowing full well we’ll be back at this after the 1st of the year,” McConnell said to CNBC reporters.

After more than 30 days of deliberating in Congress, lawmakers finally decided how much money they would send to Americans, corporations and states for assistance.

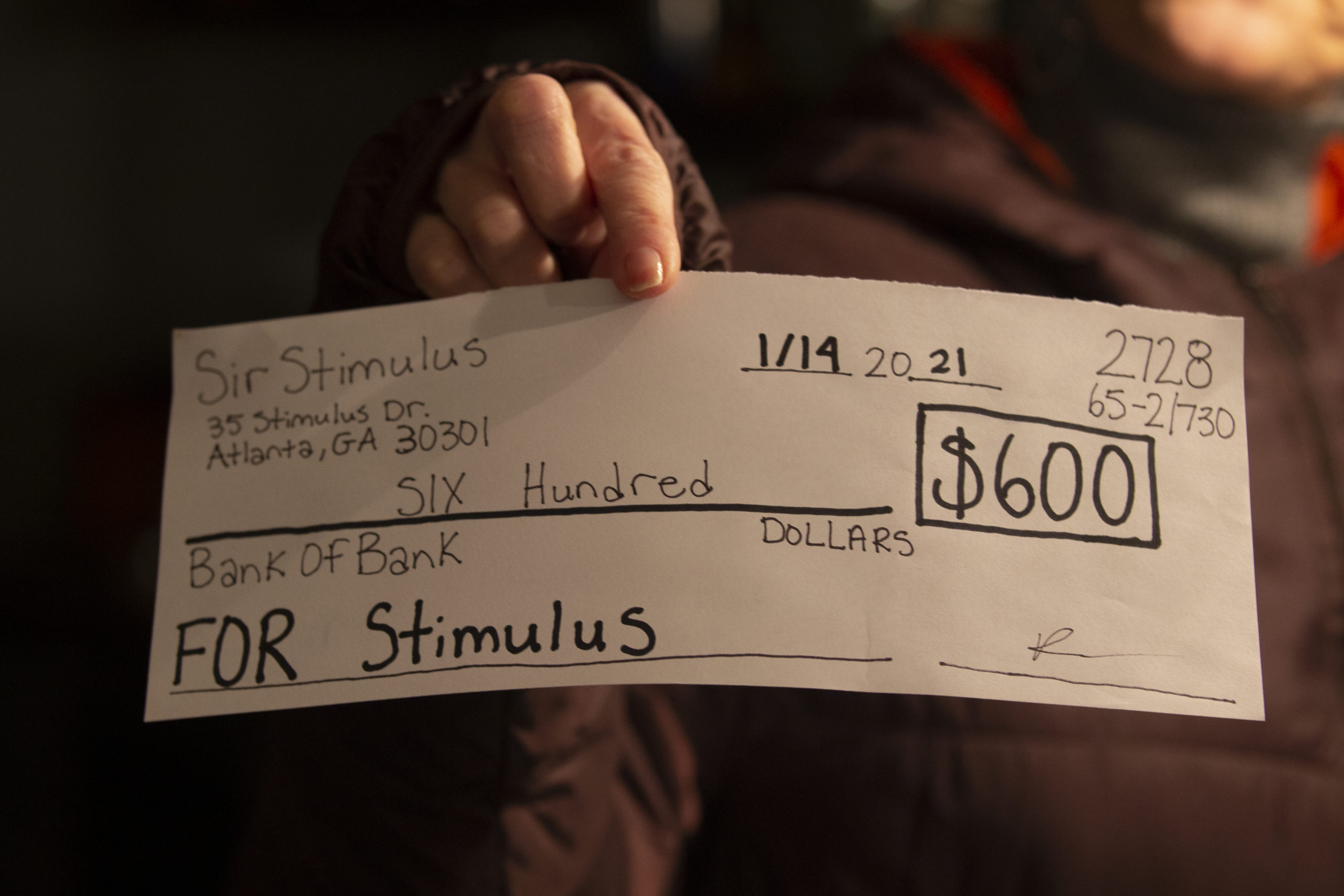

Individuals and heads of households received a one-time payment of $600, plus $600 per dependent under 18, and married couples received up to $2,400, plus $500 per child.

The bill also included $300 weekly benefits for individuals who filed for unemployment after losing their jobs or laid off during the pandemic.

Payments phased out first for Americans with an annual adjusted gross income of less than $75,000, married couples included.

For individuals who make more than $75,000 a year, heads of households earning more than $112,500, and married couples who earn more than $150,000, the amount was reduced by $5 for every additional $100 of adjusted gross income.

Most eligible taxpayers received their first Economic Impact Payment within the same week the bill was signed into law.

What if I haven’t received my check?

If you didn’t get the full amount of that payment, you might be eligible to claim a Recovery Rebate Credit when you file your 2020 federal tax return.

The IRS started sending out stimulus payments immediately, but while 80 million people can expect the money to hit their bank accounts by Wednesday, others will wait longer before the cash is in their hands.

Check the status of your first Economic Impact Payment. Some people received their payment in partial payments. If you received partial payments, the application would show only the most recent. Confirm your payment type: direct deposit or by mail.

See how much you’re eligible for here.

Who won’t get a check?

The main people excluded from receiving payment are wealthy individuals, non-U.S. citizens and “adult dependents” who can be claimed on someone else’s tax return, which means that some young people and college students ages 18 to 26 will not qualify for a payment.

Second Economic Relief Payment

Americans expected more support from the government during the pandemic to help combat the effects of the virus.

Since President Trump allowed millions of Americans’ unemployment benefits to expire and millions to lose homes and businesses in the pandemic, Americans wanted a second stimulus check or aid sooner.

The pandemic lasted almost the entire year of 2020 and claimed the lives of millions around the world, leaving many financially reliant on the assistance of U.S. government aid to survive.

Congress passed another bipartisan deal that President Trump signed into law that gives $600 checks to adults with annual incomes up to $75,000, plus another $600 per child. Some Americans earning more than $75,000 will also receive money if they meet the specific qualifications outlined below. Treasury Secretary Steven Mnuchin said he hopes to start sending out payments swiftly.

What is different from the second payments?

Mixed-immigration-status families were made eligible for this payment and the previous CARES Act payment from the spring.

Anyone in the family who is a U.S. citizen or has a “valid identification number” listed on their tax return will be eligible to claim this payment.

How does the U.S. government know where to send the money?

If you have already received a payment from the first round of stimulus checks, then the IRS will deliver this second payment in the same way.

Most Americans will receive the payment through direct deposit, but the IRS will send you a paper check if it does not have your bank details on file or you closed the account the IRS has on file.

Third Economic Relief Payment

President-elect Joseph Biden has outlined his $1.9 trillion emergency legislative package to help combat the unprecedented effects caused by COVID-19.

His plan will help fund a nationwide vaccine effort and help provide direct economic relief to Americans.

The American Rescue Plan will include a budget of more than $400 billion toward fighting the COVID-19 pandemic, $160 billion to execute a national vaccinations program, $1,400 stimulus checks for Americans and $400 weekly unemployment benefits until September 2021.

Biden has pushed Congress for $2,000 stimulus payments, which would be accomplished by passing the additional $1,400 checks.

Biden downplayed the deficit spending that his bill would require, saying that the benefits of aggressively spending to combat the economic impact of the pandemic would “far surpass the costs.”

If the Biden administration fails to gather enough Republican support, then stimulus backers could move to pass it under a process known as budget reconciliation.

This process only requires a majority vote for legislation to become law.

But what if I still have more questions?

The IRS created a FAQ website with the latest information. It is updated frequently: irs.gov/coronavirus.