Georgia State professor and Director of Economic Forecasting Center Rajeev Dhawan predicted national and local economic growth and recovery through 2017, according to a news release from the center. The Economic Forecasting Center, where Rajeev conducted his research, is based in the Robinson College of Business.

The center’s predictions suggest the economy will begin recovering in the second quarter of 2015, according to the news release. Dhawan discussed economic improvements through job growth, rising oil prices, and more housing permits.

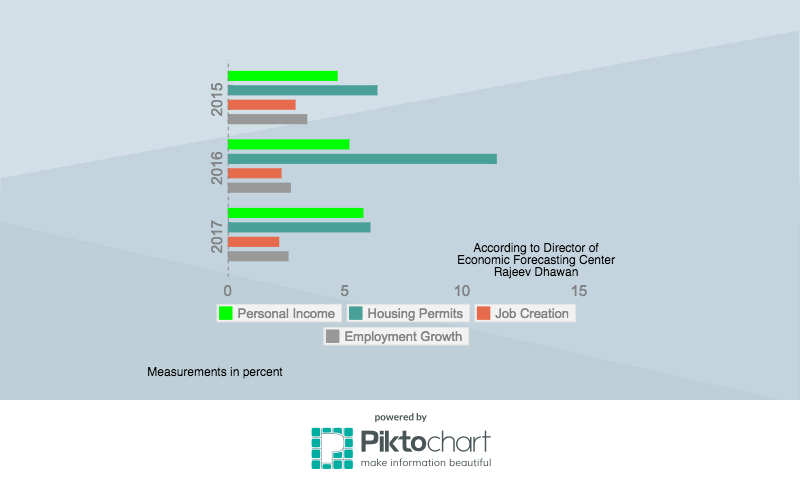

Dhawan said nominal personal income in Georgia will increase from the current 4.7 percent to 5.8 percent in 2017, and housing permits will rise from 6.4 percent in 2015 to 11.5 percent in 2016, according to the release.

Although more jobs will be created in the next few years, Dhawan anticipates job creation for Georgia to decrease from 2.9 percent in 2015 to 2.2 percent by 2017.

Georgia State economics professor Felix Rioja said 2015 is a good year for recent Georgia State graduates because there are job opportunities available.

“The forecast for the nation and for the state are positive. Despite a slowdown in the first quarter, the jobs situation is positive,” Rioja said.

Rioja said the overall increase in economic activity is good for a large research university, such as Georgia State.

“Increased economic activity in the state helps the state’s budget, which is a key determinant of state financing for public universities,” he said.

The Economic Forecasting Center also said oil prices will rise, but not to the height of $134 per barrel as during the recession, according to the news release.

“I expect oil to start creeping up to $70 a barrel by year’s end and stay in that range for the coming year,” Dhawan wrote in his “Forecast of The Nation.”

Second-year Master of Communication student Mustafa Allahrakha agrees with Dhawan’s prediction that a stagnant economy is behind us. He said he is concerned that an unstable global economic market may lead to inflation.

“If oil prices for some reason spike, then I would assume the natural gas market would creep its way into the US market,” he said.

Allahrakha said he hopes a rise in gas prices would cause competition among fuel providers would increase as well, opening the market for more fuel options.

“I am a big fan of fuel freedom and hope to see America move away from oil dependency,” he said.